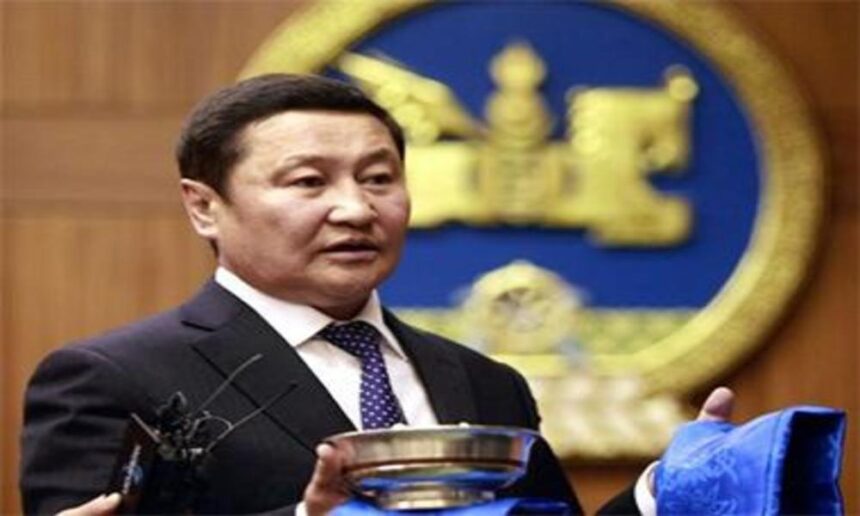

Marking the one-year anniversary of the current government led by Prime Minister Altankhuyag, some observations and inferences can be made on how the implementation of its economic policy of Altanomics (Altankhuyag+economics=Altanomics) is coming along so far.

The Altanomics action plan states, “The main macroeconomic objective is to implement budgetary, fiscal and monetary policies aimed at creating a self-sustaining and internationally competitive economy that is capable of fully satisfying domestic demands.” This policy sets out a direction rather than a destination. Its formulation, which implies that implementing policy is an objective itself rather than the destination to reach, is making it difficult to measure results.

More main macroeconomic objectives laid out are to provide the working-age population with employment and ensure that their salaries can support their livelihood; discard the social welfare policy of universal cash handouts to citizens; and support children and elders, as well as people with disabilities. The government has also emphasized its policy on taking cooperation between the government and the private sector to the next level and creating a business friendly environment.

The implementation of the Altanomics budgetary, fiscal and monetary policies pursued to resolve macroeconomic issues and their objective, to create economic competitiveness, can be measured against the progress of the promised reforms and initiatives in their action plan.

Implementation of budgetary policy

Altanomics now has two separate budgets, thus, it has become hard to differentiate their benefits. The disclosed budget passed by the parliament has currently fallen short in revenue by 1.5 trillion MNT, and the budget deficit has greatly exceeded its designated limit. It is not clear who is benefitting from the “undisclosed budget” funded by the government bonds (Chinggis Bonds) issued last December. The bond money is managed solely by the Ministry of Economic Development through the Development Bank of Mongolia. However, its management is not transparent and the public cannot see what criteria are required to use these funds, who has received allocations of the bond money, and what results have been achieved.

The government has spent its recent days making amendments to the public budget by reducing its expenditure by one billion MNT, in order to avoid exceeding the two percent ceiling of the fiscal stability law: the budget deficit cannot exceed two percent of GDP. Nevertheless, government expenditures outside the public budget still pose a serious threat to fiscal stability.

Coupon payments on Chinggis Bonds are made with public funds. Therefore, we need immediate legal regulations that will integrate the bond money being managed by the Development Bank with the public budget. Unless the government takes measures to include current and future bond money in the public budget during its four-year term, and make sure that the combined deficit does not exceed the two percent ceiling, the next government will go straight into bankruptcy in 2017.

However, the government proposed a draft law to parliament to increase the amount of external public debt to 60 percent of GDP, replacing the current ratio of 40 percent, and started working to issue additional government bonds (Samurai Bonds).

Implementation of fiscal policy

The government set forth an objective to support the development of the capital market and the private sector, by attracting investment with reforms to the stock exchange. The parliament has recently passed the Securities Law and the Law on Investment Funds, both of which were expected to be passed for many years and proposed by the government. However, there are still many things that need to be done: meet the commitments set out in the cooperation agreement with the London Stock Exchange; create a pension fund, which should have the strongest influence on the capital market; and develop institutional investors by allowing private pension funds to be formed.

In order to privatize state-owned companies, stock should be sold to the public through the capital market instead of auctions. Unless we bring it up and speed up the process, those state-owned companies will keep running non-transparent businesses with increased deficits. One third of all state-owned companies are running deficits, and 17 of the deficit-ridden companies are suffering shortfalls ranging from one to eight billion MNT. These companies are being fed by the private sector because the deficits they run are made up from state revenue generated by taxes paid by private companies. Privatizing state-owned companies through the capital market will be essential in replacing oligarchy with public governance.

The government also said, “With mining revenue, a wealth fund will be established and up to 60 percent of the fund will be reserved for the future pension fund.” It diminishes the idea of creating accumulation in a pension fund for investment purposes. It would be more appropriate to create accumulation in the existing pension fund. Also, nothing has actually been done to establish a wealth fund.

Until the interest rates of banks are lowered due to development of the capital market, the private sector will keep facing difficulties when businesses try to expand their operations.

Implementation of monetary policy

By the end of 2012, our economy started lacking money in circulation due to several factors. They include the sudden decline in foreign investment following the strategic foreign investment law passed with haste before the election, and a decrease in our exports. Also, there was the debt pressure of the 1.2 billion USD that the government forcefully borrowed from mining companies to fund the Human Development Fund.

The newly appointed President of Mongolbank has been conducting a policy to stabilize the prices of basic commodities in order to maintain macroeconomic stability, reduce inflation, protect real income and ensure the normal supply of goods.

In the framework of the various programs being implemented by Mongolbank, approximately three trillion MNT have been injected into our economy with interest rates twice as low as market value. It cannot be continued over the long term. Using soft loans to keep the prices of basic commodities from going up has risks that, in the long term, might interrupt commodity supply and inflate prices. Unless this quantitative easing policy is gradually discarded, it might put the banking sector at risk and harm macroeconomic stability.

On the other hand, if Mongolbank keeps injecting more money into the economy, the Mongolian tugrug will continue to weaken against the U.S. dollar. The policy being pursued today to allow floating exchange rates rather than using reserves, is aimed at providing continuing stability in currency rates, which is the right thing to do at this stage.

Towards competitiveness

There is not really that much that has been done to reach the government’s objective to “reduce dependency on the mining industry, achieve long-term sustainable development, and create a diversified, competitive economy.” Implementation of government policies on industrialization, wool and cashmere production, traditional animal husbandry, meat and dairy products, tourism, technology, biotechnology, nanotechnology and information technology are only in the commencement stage.

If we look at the progress of infrastructure building, road projects are going relatively well while Thermal Power Plant No.5 still has not progressed. We are greeting the tenth consecutive winter without seeing any real progress on this project since its paperwork was completed.

In order to improve the competitiveness of a specific economic sector, products from that sector need to be exported and continuously supplied to foreign markets. To succeed, fierce competition within the sector and clusters (several competitive companies) must be induced.

Altanomics is faced with many challenges and, in order to achieve its macroeconomic objectives, the government needs to prioritize its tasks for each of the objectives, work on them with great focus, and adhere to market economy principles. Improving the competency of public governance is still the biggest challenge of Altanomics.

2013.10.23