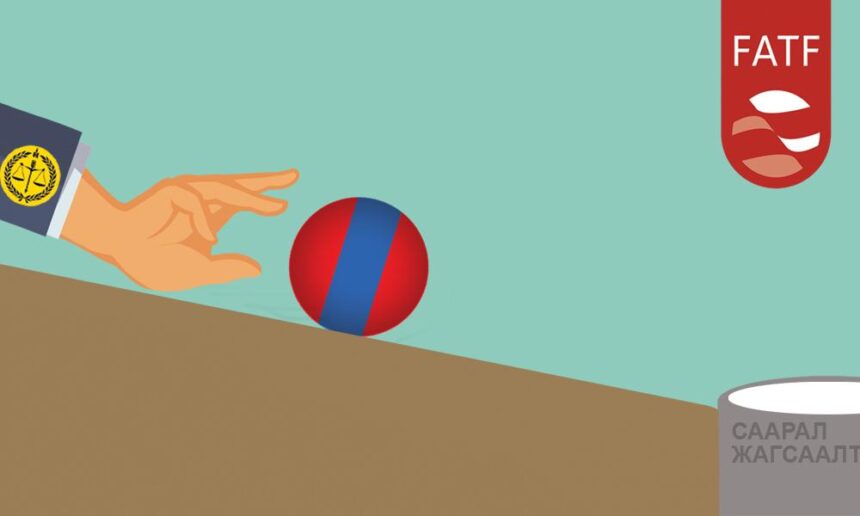

The Financial Action Task Force (FATF) held its annual meeting in Paris between 13-18 October 2019 and officially announced that Mongolia, Iceland, and Zimbabwe have been added to its grey list. The FATF publishes reports on recommended measures (40 recommendations) in combating money laundering and terrorist financing, and evaluates the progress (11 criteria) of its members. According to the Mutual Evaluation Report of 2017, Mongolia has not complied with 5 recommendations, thus the progress (in 4 criteria) was regarded as insufficient. This result was mentioned in my previous article called “Grey Government”.

The inter-governmental organization issues the following two lists. Former is the black list, a list of countries deserves the utmost attention, and the latter is grey list, a list of countries that are under observation. Financial activities with countries on the grey list are not prohibited, but the FATF provides guidance on risk assessment. As a result, banks that provide global financial services, financial institutions, and investors pay careful attention to countries on the grey list and thereby limit activities at own will.

Grounds for Grey

Ch. Khurelbaatar, a Minister of Finance, pointed out that “The Law on Pardon most significantly bred the inaction to admit and fix the wrong policy, wrong action…” The Minister of Justice and Internal Affairs, Ts. Nyamdorj, stated “The draft law on transparency was proposed and rejected in January 2015. Afterward, the draft law was forcefully approved during the Naadam festival.”

The Law of Mongolia on Promotion of Economic Transparency, a law on pardon, was in force from August 7, 2015 to February 20, 2016. According to this law, when a person registers his or her undeclared properties (cash, real estate, etc.) and pays the taxes, the source will not be questioned, a criminal charge will not be filed, the person will not be held responsible, and information regarding the property will not be disclosed. In the course of this law, 8794 Mongolian citizens, 448 stateless people, 25,000 enterprises declared properties amounting to 33.3 trillion tugriks, an amount larger than the Mongolian economy in a year.

In 2017, the APG (The Asia/Pacific Group) of FATF designated an external independent expert to Mongolia to carry out an evaluation on money laundering. The evaluation report provided clear recommendations on what to focus on and fix. Unfortunately, Mongolia was added to the grey list as the government failed to fully comply with the recommendations.

The report pointed out that Mongolia is exposed to money laundering vulnerability (p. 15). Fraud, environmental crimes, tax evasion, and corruption are at a high risk of money laundering whereas, drug offenses, smuggling, organized crimes, crimes against banking regulations, theft and burglary are regarded to beat moderate risk.

The income generated from crimes similar to the above-mentioned crimes is laundered in Mongolia or abroad. Domestically, the illegal income is used to purchase real estate, car/machinery, and high-class consumer products.

Furthermore, the money is laundered in the construction industry through legal persons. The bribes are mainly received through bank accounts of family members, and then transferred to foreign banks, offshore accounts, and other financial institutions. In certain cases, the money is transferred back to Mongolia via the banking system, and it was noted that the Mongolian banking sector is the most vulnerable to money laundering.

It is not a coincidence that an external financial auditing firm examined the Mongolian commercial banks, as the IMF demanded, to see if they involve in illegal activities to increase their equity capital. The bank of Mongolia is expected to shortly set forth the reason to the public.

Dysfunctional Court

The Mongolian court is incapable of resolving cases concerning money laundering. Many cases are investigated and many officials in high-ranking positions, such as the two former Prime ministers, former Minister of Finance, executives of state-owned companies, and the owner of the largest bank, were arrested. The above-mentioned report indicated that Mongolia lacks cooperation between the executive branch, courts, and the police agency. In short, the mechanism to enforce justice is not functioning properly, thus justice is not established.

The Independent Authority Against Corruption (IAAC) of Mongolia did submit a request to transfer several hundred cases, which it has investigated, to a prosecutor, and yet only a handful of cases are brought to court. So far, the prosecution has not released a public report on other cases brought to the prosecutor. The court trials of most cases are postponed for bizarre reasons. Subsequently, the cases get closed as the period of limitation for enforcement expires. Such strange practice has been put in place. This illustrates that the judicial system is serving corrupted officials instead of justice. The Mongolian prosecution and judicial system got into the hands of a few corrupted officials, as a result money laundering has spread to a degree that it cannot be solved domestically. Therefore, the FATF added Mongolia to its grey list.

The Mongolians are emigrating as they run out of choices when ordinary citizens grow poorer, and the corrupted grow richer by misappropriating public properties. Until which point can citizens bear it? The damages resulting of corruption are paid by citizens who place their faith in the upcoming elections. However, authorities have regularly amended the law on election in their favor. The parliamentarians have been putting their heads together to make favorable amendments to the Constitution of Mongolia for a year, distracting public attention to dysfunctional courts, and counting down the days until the election in 2020.

In truth, it means that the Mongolian court was added to the grey list.

2019.10.23

Trans. by Riya.T and Ariunzaya.M