It is said that mankind’s greatest invention is money. Some even claim that civilizations wouldn’t have been founded if money hadn’t existed. Money, in the form of coins and banknotes, has allowed people to exchange their tangible goods with other tangible goods. When money came into use, labor productivity significantly increased. It was first created nearly 30,000 years ago.

It was only 600 years ago when stocks first came into use. The invention of stocks allowed the value of money to be evaluated not only with its amount but also with time. The money that belonged to those who had an accumulation was allowed to be used by those who needed it for a specific period of time – both short and long term. It enabled the financial brokering system to be founded, laying the grounds for forming a financial market. Over the last 100 years, the financial market grew to such a large extent that the development and value creation works today cannot be fathomed without the part the financial market plays.

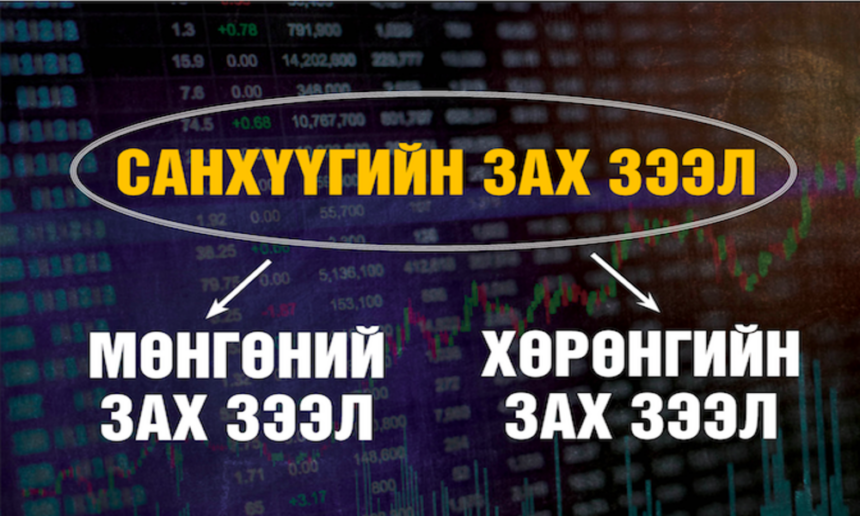

Depending on the maturity of financial instruments, financial markets can be divided into two categories: money markets (when the maturity is shorter than one year) and capital markets (when the maturity is longer than one year). Companies use the money market to raise a loan that comes with interest payments and go to the capital market to sell their shares and distribute dividends.

Mongolians are very familiar with the money market, but when it comes to the capital market, we’re only just getting to know it. The big privatizations weren’t intended to raise capital. The intention was to divvy up existing capital. Even 30 years on, we are still paying for its consequences.

Until recently, all businesses in Mongolia have raised funding from the money market, by obtaining loans from commercial banks. In the last few years, a small number of companies have raised capital by becoming listed on the stock exchange. Some companies even raised capital worth hundreds of millions of dollars from foreign markets. Some have become a dual-listed company. However, the larger capital you raise, the greater scrutiny you come under.

Raising capital by selling shares

The market capitalization of the Mongolian stock exchange has risen twofold in the last two years to reach 2.5 trillion tugrugs, which equals 9 per cent of GDP. At the end of 2018, the total amount of loans granted for commercial and personal reasons reached 17.2 trillion tugrugs, which equals 62 per cent of GDP. This means Mongolia’s financial capital equals about 70 per cent of our economy. It also shows that the capital accounted for by the money market is sevenfold larger than that accounted for by the capital market. The message is that the capital market has a lot of room to grow.

Mongolian companies are learning to raise capital on both domestic and foreign stock exchanges. For example, Mongolian Mining Corporation raised 670 million USD from the Hong Kong Stock Exchange. Petro Matad was listed on the London Stock Exchange. Another company raised capital from two different international stock exchanges at the same time. Southgobi Sands is listed on both the Hong Kong and Toronto stock exchanges. Turquoise Hill, which owns 66 per cent of Oyu Tolgoi, is listed on both the New York and Toronto stock exchanges. Erdene Resources did their Initial Public Offering (IPO) on both Toronto and Mongolian stock exchanges. You may have noticed that all of the above mentioned companies are in mining, as it is an industry where a lot of capital is required to carry out exploration or extraction activities.

Doing an IPO comes with a great responsibility, because investors need to have the trust that there will be profit when they decide to invest their capital in buying shares. Some investors expect share prices to increase when the value of the company increases. When it happens, they can generate profit by selling the shares they bought.

The key function of the stock exchange lies in ensuring that the information related to a listed company is truthful and accurate, requiring any material information to be provided to all investors at the same time, and making sure that companies meet their reporting requirements, such as publishing quarterly reports on time. For example, the Toronto Stock Exchange has a mechanism whereby undercover experts are sent to mine sites to get a firsthand understanding and confirming mineral results by independent mineral sampling.

These requirements are in place because the capital raised from a stock exchange often belongs to individuals and investment funds, including national pension funds. All companies listed on international stock exchanges are publicly traded, which means anyone can buy and sell their shares. Mongolians have already been buying shares. There are several examples where a group of Mongolian employees working in an international company decided to buy shares of their employer. For instance, Mongolian citizen Ts. Tserenpuntsag purchased 32 per cent of Aspire Mining, which is listed on the Australian Stock Exchange, last fall.

The primary responsibility of a stock exchange is to protect the interests of investors. Stock exchanges also require publicly traded companies to be transparent, have social responsibility in the locations they operate in, and carry out rehabilitation as required. The companies benefit from meeting these requirements as well, because it helps them run their operations and enables them to raise additional capital by offering more shares if required. Therefore, the listed companies that are operating in Mongolia have good governance, which is seen by how they engage with local communities, report on their operations, and provide assistance as needed. It is their key difference from those companies that are closed to the public and owned by a single owner.

Stock price sensitivity

Share prices play an important role in the operational performance of a listed company. If the price is stable or growing, it means the company is performing well. Companies offer their shares not as a whole, but partially. Therefore, when issuing another round of shares, they look at the price of their shares set by secondary traders, i.e. those who didn’t trade with the company directly.

The price of shares also indicates investor expectations. Information that pertains to listed companies is often obtained and reported on by financial experts and the media. Therefore, it is critical that such information and reports need to be accurate. Inaccurate reports can negatively impact business performance and make share prices plummet.

On 28 November 2018, Bloomberg TV Mongolia broadcast a story that said South Gobi Sands was in default. The story said ‘South Gobi Sands, which runs mining operations in Ovoot Tolgoi, hasn’t made their payment of 41.8 million USD to China Investment Corporation (CIC) on time, within 19 November 2018… The company declared default because they haven’t agreed on a repayment plan…’ Following this news soon after, zindaa.mn posted that South Gobi Sands had gone bankrupt.

Because of this inaccurate reporting, there was an immediate reduction in the share price of South Gobi Sands, which employs 500 people and runs a coal mining operation at a deposit of 786 million tonnes of coking coal. Subsequently, it impacted their operations as the news unsettled their 270 suppliers, who provide goods and services such as fuel, food, and clothing, and forced some to ask for advance payments.

The reality was that CIC, which is an investor of South Gobi Sands, had posted on their website, as per the stock exchange requirements, that the repayment of the loan was unable to be made at that time due to clarifications that needed to be made to there payment plan over the remaining 25 years. It was misinterpreted by many Mongolians due to the inaccurate reporting.

Instead of understanding the difference between default and bankruptcy, media outlets assumed they were the same and published a news story that upset many investors, including employees of the company.

This is a clear example of the strong scrutiny listed companies operate under and how transparent their information and performance must be kept. It also shows how fast the market can respond to small errors and inaccurate reporting. The capital market is very vulnerable in this regard.

It is time to develop the capital market in Mongolia and ensure its players are well informed and well educated.

2019.02.20

Trans. by B.Amar