Seventy five years ago Mongolia started work to protect its people from poverty and inequality. Since then our population has grown by almost 500 per cent, and social care kept expanding to its current state – a large system incorporating insurance and care. However, this system is not delivering on its objective to safeguard society from poverty, and has been ineffective in reducing poverty levels.

Today social care comprises one fourth of the public budget, and has seen a consistent increase in spending every year. It is now stifling the expenditure dedicated to creating value and developing the economy. We see inefficient management of deposits in social care funds. Extremely populist policies have created a social care system that exceeds our economic capabilities, which hiked the budget deficit and put the government in debt. When the government increases the rates of many kinds of taxes, the private sector is being discouraged from creating jobs. And poverty levels are not going down because Mongolians are unable to find employment.

Our government policy, which is intended to protect society from poverty, has now ended up shackling our economic development, instead of complementing it. Let’s have a look at pension insurance as an example.

Revenue and expenditure are distant from each other

Mongolia’s insurance scheme today consists of five types of mandatory and non-mandatory insurances: pension insurance, benefit insurance, health insurance, insurance against employment injury and occupational diseases, and unemployment insurance. The total revenue from these insurances, excluding deductibles and including budget subsidies, reached 1.8 trillion MNT (7.6 per cent of GDP), and the expenditures were 1.7 trillion MNT (7.2 per cent of GDP) in 2016.

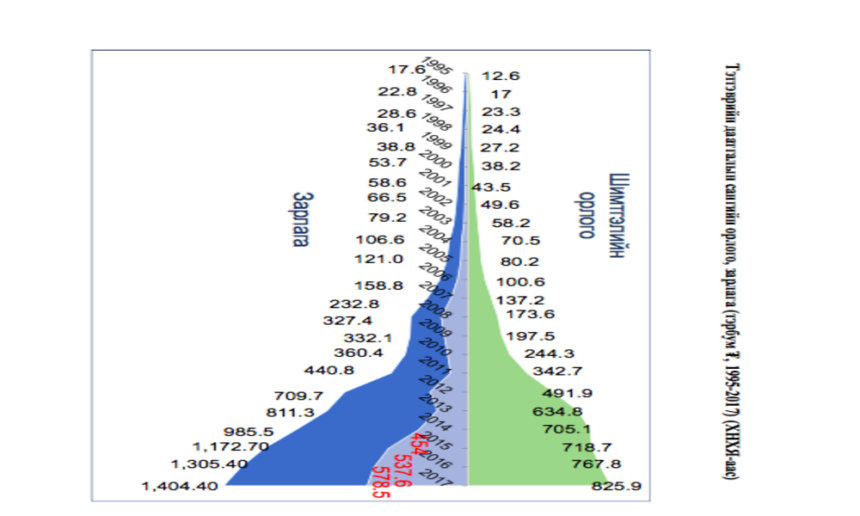

Last year 80 per cent (1.4 trillion MNT) of total expenditure was comprised by the pension fund. The deductibles from pension insurance reached 825 billion MNT, and its 578 billion MNT gap (40 per cent of expenditure) was made up by the government. There is no other source than the public budget to pay for the pensions of people who retired before 1995, military retirees, and additional pensions (Graph 1).

In 2016, Mongolia’s population was 3.1 million, 2.1 million of which were of working age. Only half of them participate in pension insurance. Approximately 800,000 of those who participated in the scheme were on a mandatory basis, meaning that their salary is automatically deducted. These made up 93 per cent of total revenue from deductibles. The remaining 7 per cent was covered by those who paid for insurance on a voluntary basis.

A total of 372,000 people received pensions in 2016, and 70 per cent (~268,000 people) were elders. The rest were disability or loss of breadwinner pensions. Furthermore, the government viewed that it was impossible to determine how many years a person spent working and how much salary they had before the democratic revolution. On this basis, the government added 10 years to the working years of almost 20 thousand people. This is the reason for the sudden 500 per cent increase in persons receiving pensions compared to 2014.

Since the 1995 reform in pension insurance, it has become impossible to implement the policy to use revenue to cover the expenditure of the fund. The pension insurance subsidy from the public budget has been increasing, and is expected to continue rising. The Ministry of Labor and Social Protection has projected that the pension fund deficit will reach 12 per cent of GDP in the long term if this trend is maintained.

As the average age of population rises, there are more and more pensioners in the population. In 2013, there were 4 pensioners per 10 people who are insured, and the ministry expects the number to rise to 7 in 2030, and even 9 later on.

Deductibles and livelihood

Although 12 per cent of Mongolia’s population is receiving some kind of pension, 20 per cent are still living in poverty. If we say two people are dependent on one pensioner, 800,000 people, which is 25 per cent of our population, are living dependent on pension income. Nevertheless, the income people get from their pension can barely help them meet their basic needs, let alone assist others.

In 2016, Mongolia’s minimum livelihood guarantee was 170,000 MNT, and the average pension stood at 300,000 MNT, whereas the International Labor Organization estimated the average salary at 415 USD. This shows that the average pension equals one third of average salary.

Legally, old age pensions become eligible for those who paid pension insurance deductibles for 20 or more years. When determining the amount, 20 years turn into 45 per cent with an additional 1.5 per cent for the number of years a person has paid the deductibles after working 20 years.

Mongolia’s average life expectancy reached 69.1 years in 2014 – an increase of 5.9 years from 2000. The average life expectancy was 65.4 years for males, and 75 years for females. The Ministry of Labor and Social Protection estimates that a male who retired in 2013 would receive a pension for 15 years, while this would extend to 15.8 years and 16.2 years if they retired in 2020 and 2030 respectively. Females, who were 55 years old in 2013 and retired, would receive a pension for 23 years. If females retire in 2020 and 2030, they would receive a pension for 23.5 and 24.6 years respectively.

If you look at the time period of how long a person has been paying pension insurance, it comes to 25.6 years for males, and 26.1 years for females. This means (according to the Ministry of Labor and Social Protection) males are receiving a pension for 15 years after paying deductibles for 25.6 years, and females are receiving a pension for 23 years after paying deductibles for 26 years. The active and inactive durations are getting closer for females, which is increasing the pressure on the amount of pension and expenditures of the insurance fund.

Insurance receivers who were born after 1960 have been opening artificial accounts starting from 2000, where paid deductibles are registered every month. As of 2014, 1.1 million insurance receivers opened accounts for pension insurance deductibles, and artificially registered total deductibles of 6.9 trillion MNT. But, in fact, 73 per cent of these people paid deductibles for less than five years.

Policy to reform

Unless the pension insurance policy and scheme are reformed, Mongolia’s pension insurance will soon go bankrupt. It is time to retire the already dysfunctional pension insurance, and re-organize it completely.

While the age structure of our population is favourable, we need to reform the pension scheme, optimise the estimation of insurance deductibles, pension ages, and pension amounts, and transition into a multi-layered system.

Also, the scope of pension insurance needs to be expanded, so that herders and those who work in non-formal sectors are covered. Although the required legal environment is already there, the current system has only 9.1 per cent of 261,700 herders included in the pension insurance scheme. We need to make sure that our elders are at least receiving the same amount they paid for deductibles in the form of pensions, and ensure fair distribution in society. If we manage to do so, the future expenditure of care funds will be reduced.

It is time to start reducing the pension fund deficit, turn the fund’s revenue into financial investments, estimate its yields when estimating pension, and move the pension fund into a semi-accumulation system.

Also, when people in specific sectors are receiving significantly more salary than the national average, demand has risen to acquire additional pension insurance in order to ensure their future income. Some banks have established private pension funds as leverage to retain their employees. There is a need to guarantee the right of high income insurance receivers to participate in additional private pension insurances, regulate the private pension fund sector, and develop the legal environment to protect against risks.

2017.09.20

Translated by B.Amar