In 2023, Mongolia’s GDP reached nearly 70 trillion tugriks, with 3% attributed to the construction sector’s output. At end-user prices, this amounts to 2.1 trillion tugriks. The total performance of construction and major repair work (gross output) in 2023 was 7.2 trillion tugriks. The construction sector comprises 7,200 enterprises, 84% of which are concentrated in Ulaanbaatar due to the population cluster, corresponding to 50% of total construction activities. By type, in 2023, residential buildings accounted for 40%, non-residential buildings for 34%, engineering structures for 22%, and major repair work for 4% (according to NSO).

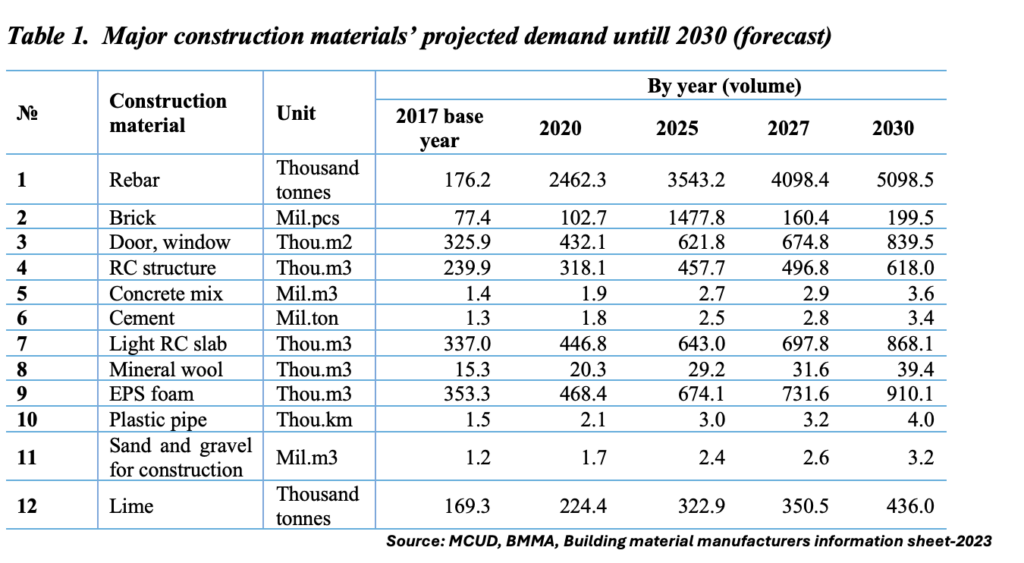

The Building Material Manufacturer’s Association of Mongolia (BMMA) and the Ministry of Construction and Urban Development (MCUD) predict that the demand for all major types of construction materials will double between 2020 and 2030.

This forecast also emphasizes the need to account for differences in the inputs required for green buildings and structures equipped with renewable energy systems, as demand for such constructions is expected to rise in the near future.

Supply of Construction Materials

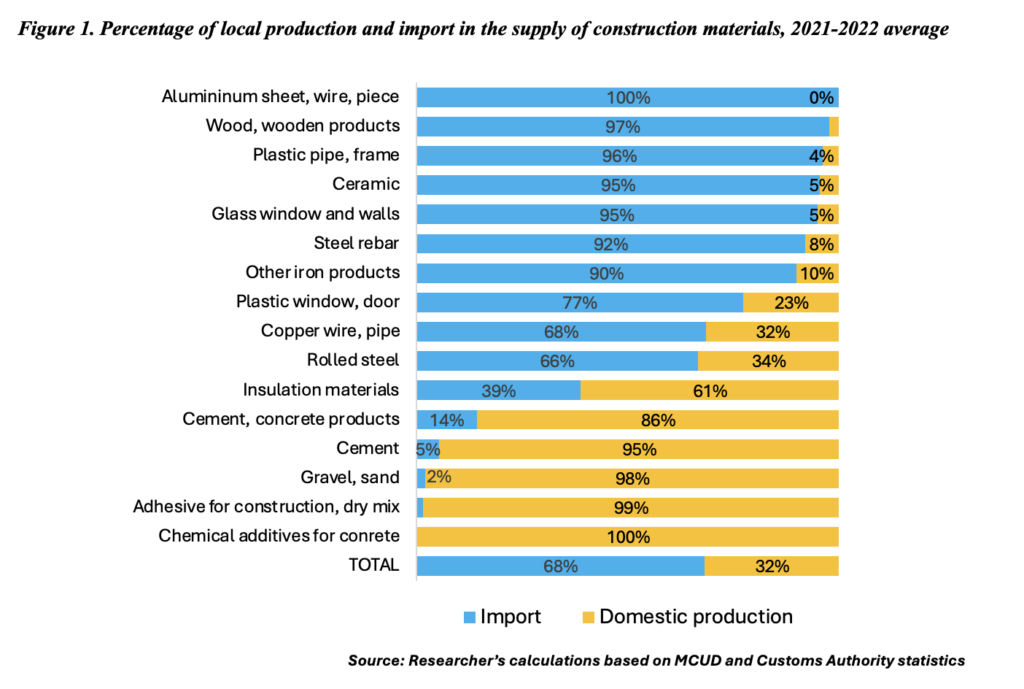

More than half of the total supply of construction materials consists of steel reinforcement bars, rolled steel, and other iron products. Cement and concrete products account for 14%, wood and wooden products for 13%, cement for 10%, and 1-3% is attributed to plastic pipes, plastic windows and doors, aluminum products, thermal insulation materials, window and wall glass, gravel, crushed stone, and sand. Copper wires and pipes, adhesives, dry mixes, and concrete chemical additives make up about 1%.

From 2021 to 2022, imported materials made up nearly 70% of the total value of construction material supply, while domestic production contributed 30%. Figure 1.

In 2021, Mongolia imported $338 million worth of construction materials, which increased to $484 million in 2022. Although domestic production is gradually growing, the sector remains less competitive. Despite the existence of import tariffs, domestically produced materials are costly compared to those imported from neighboring China. Since 2017, four large factories with the capacity to produce up to 1 million tons of cement annually have been operational, but their combined production in 2022 reached only 1.4 million tons.

The efforts to replace imports

As of the end of 2022, there were 69,539 registered small and medium-sized enterprises (SMEs) in Mongolia, of which 92% had fewer than 10 employees, and nearly 80% were classified as micro-enterprises with annual revenues of up to 300 million MNT (NSO). Approximately 10% of these SMEs operate in the construction sector. Despite accounting for 70% of the market, imported construction materials are often substandard, with 40% of materials sold failing to meet quality standards, according to the MCUD.

Therefore, it is necessary to objectively measure and evaluate the current competitiveness of SMEs in the domestic construction materials manufacturing sector – which has to replace imports, identify their strengths and weaknesses, and provide relevant stakeholders with the information, insights, and recommendations needed for effective planning and decision-making.

To achieve this, the NGO Development Solutions led a study on the sector’s SME competitiveness in the sector using the SME Competitiveness Grid Assessment Methodology developed by the International Trade Centre (ITC). The study assessed companies’ competitiveness based on three core capacities—to compete, connecting, and change—across three economic levels: micro, meso, and macro.

The study included 101 construction material manufacturers actively operating in Ulaanbaatar and 12 provinces. Among them, 36% were classified as micro-enterprises, 31% as small, and 33% as medium-sized businesses. Nearly half of these manufacturers are located in Ulaanbaatar. In terms of production categories, 27% produce materials such as concrete mixes, concrete blocks, and concrete structures while 18% manufacture windows and doors and 12% produce aggregates like gravel, sand, and stone, as well as cement. The remaining manufacturers produce various other types of construction materials.

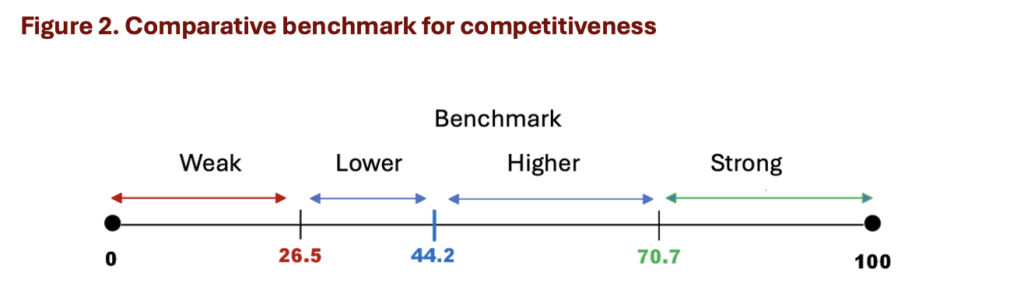

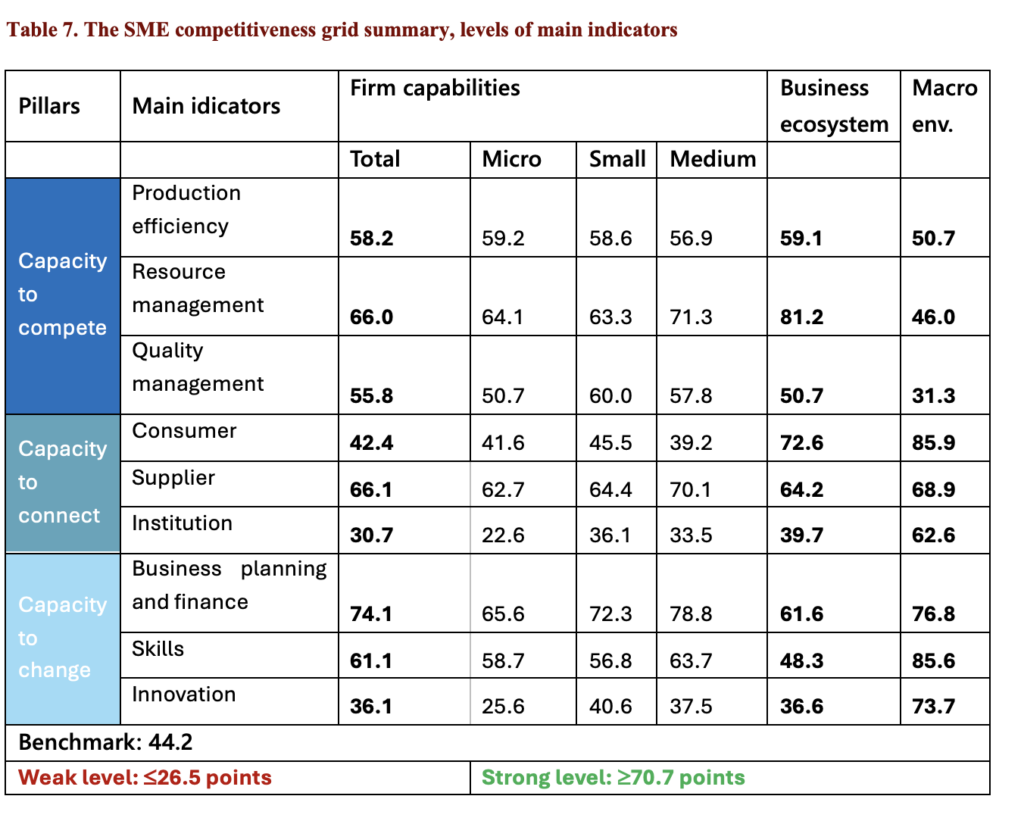

The International Trade Centre (ITC) defines competitiveness levels using a comparative benchmarking scale, where scores above 60% indicate strong competitiveness and scores below this threshold indicate weaknesses. For Mongolia, the overall benchmark is 44.2%. The weak and strong areas are 26.5% and 70.7%, respectively. Figure 2.

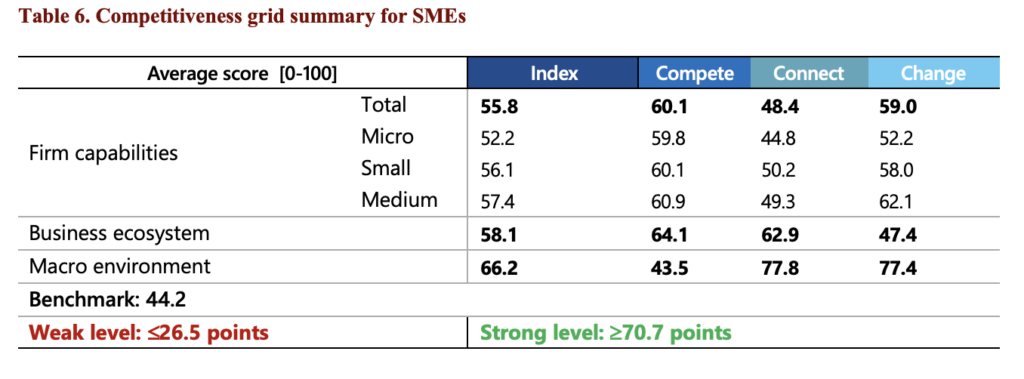

The small and medium businesses’ competitiveness indicators are as follows:

- Firm capabilities: overall score 55.8, capacity to compete 60, capacity to connect 48, capacity to change 59. While the capacity to connect scored the lowest, it still exceeded the benchmark.

Larger businesses showed higher competitiveness, indicating that construction material SMEs need to focus more on improving their capacity to connect.

- Business ecosystem: overall score 58, capacity to compete 64, capacity to connect 63, capacity to change 47. All three dimensions scored above the benchmark, though adaptability remains the weakest.

- Macro environment: overall score 66, capacity to compete 44, capacity to connect 78, capacity to change 77.4. While competitiveness was below the benchmark, to capacities to connect and change were rated strong.

While the capacity to compete of company capabilities exceeds the benchmark, it has not yet reached a strong level. Micro-businesses demonstrate weak quality management practices, with low participation in national and international quality certification programs. In contrast, resource management is rated strong for medium-sized businesses, reflecting improved income and expense tracking, as well as cash flow management, as businesses grow. Production efficiency scores are above the benchmark but show a negative correlation with business size.

Capacity to connect: Supplier connectivity was rated above the benchmark while customer and institutional connectivity both scored low. Businesses lack effective communication with customers and do not prioritize collecting or utilizing customer data. Similarly, collaboration with institutions like chambers of commerce and professional associations is uncommon, with most businesses focusing heavily on supplier connections.

As for the pillar of capacity to change, business planning and finance rated strong, skills scored above the benchmark while the innovation scored lower. Business planning and financial indicators grow as the businesses grow in size. Medium-sized businesses had better-qualified human resources. Innovation remains the lower than the benchmark component for all, with micro businesses evaluated as weak.

Business Ecosystem: capacity to connect with customers and suppliers is rated above the benchmark while it was below the benchmark when it comes to institutions. In the macro environment, the potential to connect with customers, suppliers, and institutions is strong. However, SMEs are not fully utilizing these opportunities.

Capacity to change wasrated strong in the macro environment but it was rated lower than the benchmark in the business ecosystem. Capacity to compete, on the other hand,scored below the benchmark in the macro environment.However, itscored above the benchmark at the company and business ecosystem levels.

The construction materials manufacturing sector in Mongolia, along with the SMEs playing a key role in the industry, presents the above picture. This analysis does not address all challenges faced by the sector, such as the supply and demand for skilled labor, the seasonal nature of work, or low wages and returns, among others. For a more detailed assessment, the full report can be accessed here, allowing businesses to evaluate and benchmark their own performance.