Local elections were held in Mongolia on the 15th of this month. The MPP (Mongolian People’s Party) won 34 of the 45 seats in the Citizen’s representative meetings of the capital city where a half of the population resides. Is it a coincidence that the MPP government lowered mortgage rates to 6 percent in the run-up to the election? Would it be surprising if another announcement of reducing the mortgage rates, to four percent, emerges prior to the presidential election?

Therefore, the question is: if the government makes promises and succeeds to reduce the rates before elections, can mortgage rates be set simply at 2-3 percent, as in developed countries? How are mortgages regulated? When and how will Mongolia provide apartment for every family?

The mortgage loan process

For a person to live, at least three basic needs must be met: food, clothing, and shelter. Any poor citizen in a developed country has access to hot and cold water, toilets and shower at home. More than half of the Mongolian population lives in gers and houses with pit latrines. Yet thousands of new apartments are not selling.

Twenty years ago, Mongolians began to mine and sell the minerals, leading to significant foreign exchange earnings. Soon after that, almost everyone set up a construction company in a trend to supply the housing demand that emerged.

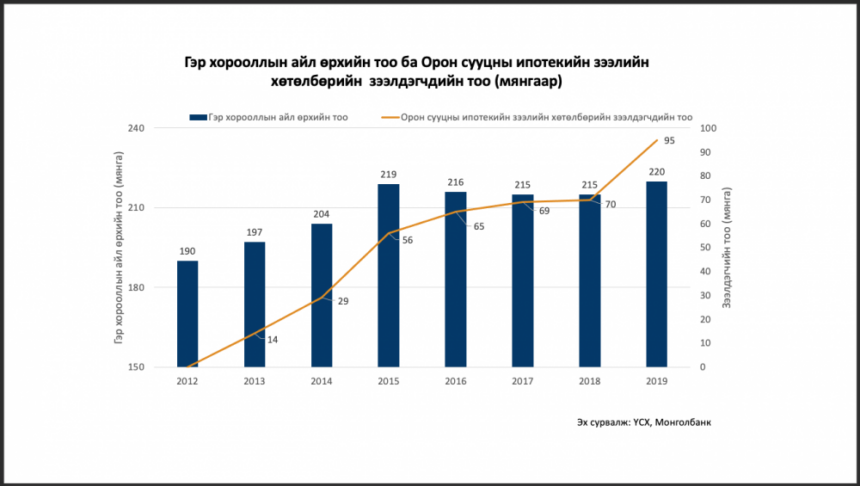

Besides selling mining licenses, officials have filled their pockets by stealing land from Ulaanbaatar. Urban planning was completely disrupted and housing prices skyrocketed. First, wealthy families moved into new apartments. The Bank of Mongolia initiated a low-rate mortgage program for low-income families in 2013. As a result, 100,000 borrowers received 4.9 trillion Tugriks in mortgage loans at 8 percent per annum.

Starting this month, the interest rate will be 6 percent and another 300 billion Tugriks will be issued in loans. Individuals with a monthly income of less than 1.5 million Tugriks who are buying an apartment for the first time will be eligible. Moreover, at least a quarter of the loans will be allocated to rural areas and at least 15 percent to government employees. This loan will allow 1,500 households to live in apartments, while in Ulaanbaatar alone, 200,000 apartments are currently needed.

Who came up with mortgage schemes?

Providing housing to citizens is subjected to budget. Thus, in most countries, it is the government, not the Central bank which is responsible for mortgaging schemes. This is because the money market is the field for short-term financing. Mortgages are long-term and are funded by the capital market. Therefore, the two markets are linked when collaterals (housing) for long-term loans are combined and asset-backed securities or interest-bearing bonds are issued. That link is formed by the housing finance company (HFC).

In Mongolia, this work was initiated by the Bank of Mongolia (BOM), not the government. Since 2013, the BOM has been printing money and has issued 4.9 trillion Tugriks so far in “soft loans” to individuals through commercial banks. They also initiated a price stabilization program and provided 2 trillion Tugriks in soft loans to construction material producers. As a result, there has been a sharp increase in money supply, and instead of stabilizing prices, this led to doubled housing prices and a drop of the Tugrik to half its value. But since the price difference is paid by every citizen through taxation, it is a burden for them, not a discount.

Mongolia’s mortgage loan portfolio now stands at almost 5 trillion Tugriks, of which 2.8 trillion was provided by the BOM, 2.1 trillion by commercial banks, and 300 billion by the government. The Mongolian Mortgage Corporation (MIK) is responsible for raising funds by issuing bonds on the capital market as secured by the collateral for loans from commercial banks. Although MIK’s bonds have a maturity of 30 years, with an interest rate of 11 percent for commercial banks and 4 percent for the Bank of Mongolia, commercial banks have sold almost all of their bonds to the Bank of Mongolia.

MIK was originally established by commercial banks on an equal footing, with the BOM having privilege. But now the Development Bank has 14.9 percent, the Bank of Mongolia 2.03 percent, the State Bank 2.35 percent is making up total 19 percent state ownership, TDB owns 9.99 percent, and Asia Diversified Real Estate Fund (MIK’s own Investment Fund) 11.17 percent, MIK HFC LLC 19.78 percent, MIK Active 6.4 percent, TDB capital 9.22 percent, Ulaanbaatar City Bank 10 percent, Capitron 1 percent making up a total of 60 percent affiliated with TDB, and the rest is owned by Golomt Bank 4.94, Xac Bank 1, Khan Bank 1 and others respectively.

D. Erdenebileg, the owner of 95 percent of the TDB, also runs the housing market. He is a “financial magician” who has been privatizing state property for many years and has a great deal of influence on the government. Read more about this man who proves that the bank has money and money has power in two articles, “Erdenebilegizm I and II”. To cite just one example: he demolished the Children’s Library, an important symbol of the capital city, and built a bank of glass and concrete instead. The 11th-12th floors of the building with a total budget of 27 billion Tugriks were sold to the state-owned Development Bank for 27 billion Tugriks and the 10th floor was sold to MIK for 15 billion Tugriks, exploiting state purchases. He also took 49 percent of the Erdenet factory from the Russians with state money and when that was revealed, he was arrested for several days, but soon fled the country. Today’s authorities and many media outlets are afraid to talk about, or even think about this case.

New scheme for mortgage

It will take another 20 years for D. Sumiyabazar, the brand new mayor of Ulaanbaatar, to provide 150,000 households with housing or at least 10,000 families per year, as his party had promised. Therefore, there is no other option but to still issue the current soft loan. Things may turn out well, if the interest rate is not lower than the Central bank’s policy rate.

MIK has 68,000 out of 100,000 apartment certificates as collateral. MIK charges an interest rate of 1.63 percent on its bond payments, which means that the same amount from the 8 percent interest rates goes to this company. MIK has issued 4 trillion Tugriks worth of securities domestically and $ 300 million abroad through 25 special companies. MIK is making a profit and using it to create a contingency fund.

This time, however, the government is seeking new mortgage practices, rather than the old “too smart” scheme ordered by one man. The state has established a state-owned HFC called the State Housing Corporation of Mongolia (SHCM) and the capital city authorities established the Capital City Housing Corporation (CCHC). Currently, the BOM and the Ministry of Construction and Urban Development are jointly establishing the National Joint Housing Corporation (NJHC). Housing projects are likely to be financed, allocated and managed by this organization. In fact, for an apartment to be built by a selected third party and sold through a commercial bank for cash, credit or rent, reduces the risks. The former head of the SHCM is now in prison for failing to do so.

There should be competition when mortgage-backed bonds are issued. However, given that the gap between Mongolia’s commercial loans and mortgages is 10 percent, investors are reluctant to buy the bonds. Theoretically, long-term loans are financed by long-term assets, such as pensions, insurance, central investment, and hedge funds. Until such funds are established in Mongolia, the government will have no choice but to bear the interest rate difference.

Commercial banks also need to abandon their construction businesses with their other businesses, to avoid forcing their affiliated housing to borrowers, to increase their capital, and to reduce non-performing loans. That is why the IMF is urging the Bank of Mongolia to suspend their budget operation.

The housing situation of Mongolians will now depend on the newly schemed agency’s capacity to operate transparently and embezzlement-free. While Mongolia has both freedom and resources, we only lack good governance. The good governance itself depends on the citizens’ participation.

2020.10.26

Trans. by Riya.T and Munkh-Erdene.D