Inflation is the most sensitive indicator of Mongolia’s economy—in simple terms, it reflects the continuous rise in the cost of goods and services that households consume daily. As of July 2025, inflation stands at 8 percent, which is above the Central Bank’s target of 6 percent, and continues to put pressure on household purchasing power.

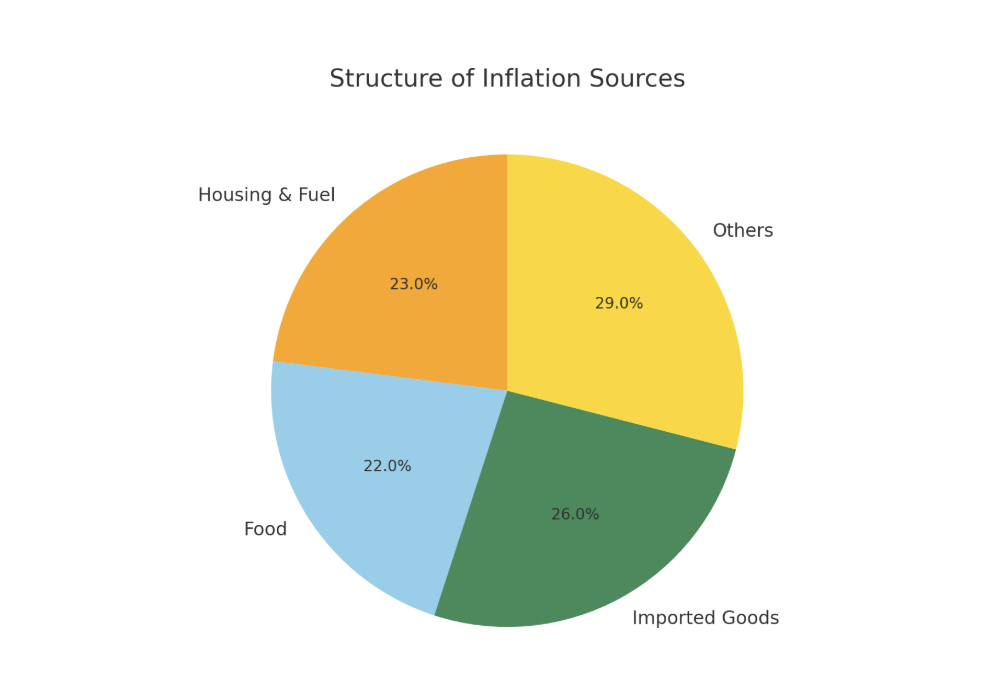

Three key factors have driven the current inflation. First, food prices have risen. The prices of meat, flour, and vegetables fluctuate seasonally, compelling pressure on the consumer basket. Second, housing-related expenses—including rent, electricity, and fuel—have increased, raising the cost of living. Third, because Mongolia relies heavily on imports for most consumer goods, fluctuations in global markets and changes in the exchange rate of the tugrug directly affect prices.

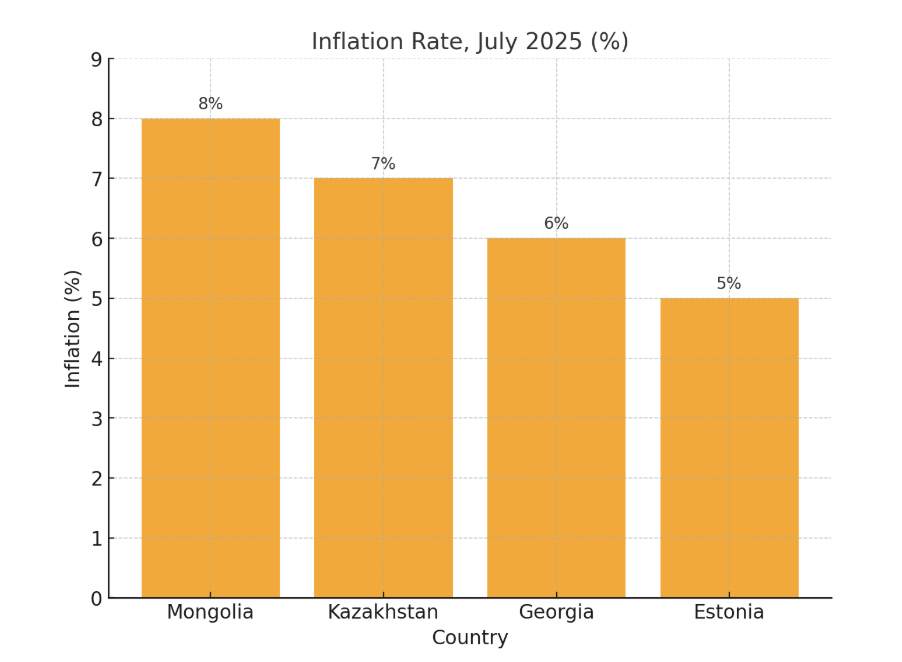

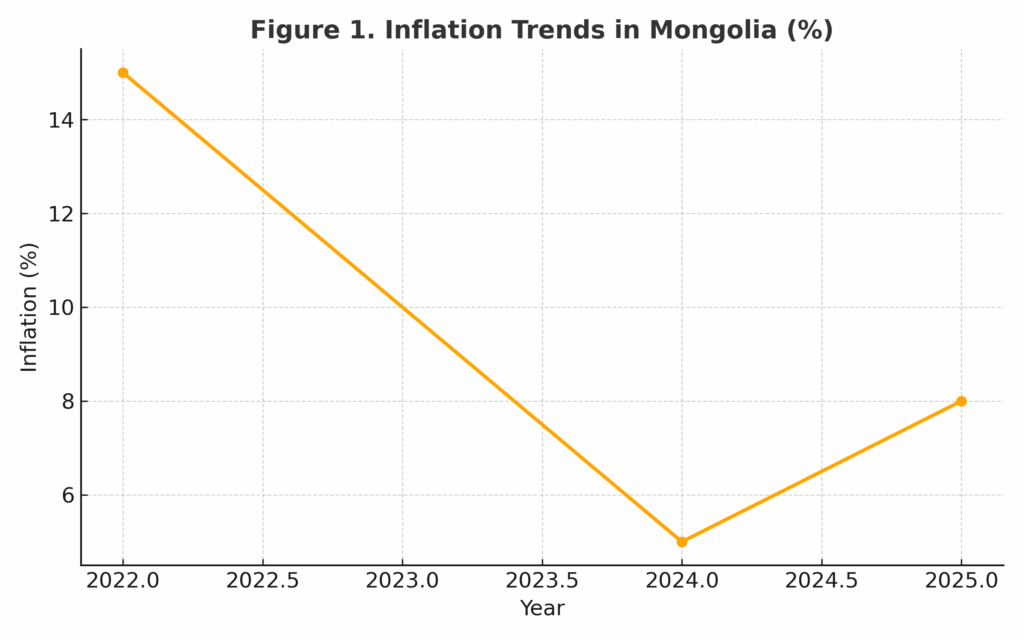

Inflation peaked at 15 percent in 2022, its highest in recent years, before dropping to 5 percent in 2024. However, it has rebounded to 8 percent this year. Compared globally, inflation in Mongolia remains relatively high: 7 percent in Kazakhstan, 6 percent in Georgia, and 5 percent in Estonia.

Under this circumstance, the Central Bank has maintained a high policy rate of 12 percent to restrict money supply. However, its ability to act independently is constrained by political pressure and the government’s short-term interests, weakening its effectiveness in stabilizing inflation. In Mongolia, monetary policy is overly influenced by fiscal expansion and election-driven decisions, which remains its biggest weakness.

The government, meanwhile, has avoided sharp one-time increases in energy and heating tariffs, but years of delayed reforms have created accumulated pressure in the sector. Subsidies are being used to temporarily suppress price hikes, but these ultimately widen the fiscal deficit and further fuel inflation.

Mongolia’s external debt remains high, while global borrowing costs are elevated, placing heavy strain on the budget. Servicing this debt increases demand for U.S. dollars, weakening the tugrug and driving up the price of imports—feeding back into inflation. To cover debt obligations, the government has resorted to issuing new bonds and securing foreign loans, a stopgap measure that is unsustainable in the long term.

If the government issues domestic bonds, both benefits and risks arise. On the positive side, this could reduce reliance on costly foreign debt, ease exchange rate pressures, and deepen the domestic financial market by offering investors stable-yield instruments. On the negative side, excessive issuance of government bonds could crowd out bank lending and reduce private sector investment. High-yield bonds would also push up overall interest rates, increasing the financial burden on households and businesses. Therefore, disciplined and balanced issuance of domestic bonds is essential.

The main driver of seasonal spikes in inflation is food prices, particularly meat and flour. Strengthening Mongolia’s food supply system—beyond simple stockpiling—requires an integrated approach that covers storage, logistics, wholesale markets, and quality control. Strategic reserves of meat and flour, cold storage facilities, transport infrastructure, transparent wholesale exchanges, and robust food safety standards are all crucial for stabilizing supply and easing inflationary pressures.

Another important tool for reducing inflationary pressure is competition policy. This means breaking down monopolistic dominance, preventing price collusion, ensuring transparency, and supporting the participation of small and medium-sized enterprises. Artificial price hikes in fuel, meat wholesaling, and supermarket chains directly burden consumers. A healthier competitive environment would expand consumer choice and help stabilize prices.

Conclusion

In the short term, stabilizing currency fluctuations and effectively managing fuel reserves are key to controlling inflation. Over the medium term, deeper systemic reforms are required: avoiding excessive fiscal spending during revenue booms, building foreign exchange reserves, reforming the food supply system, and strengthening competition policy. Implemented together, these measures could gradually bring inflation back within target levels.

Ultimately, inflation is the “fire” of the economy. Extinguishing it requires a four-pillar approach: tight monetary policy, fiscal discipline, food system reform, and competition policy. Above all, unless policymaking institutions can act independently from politics and base their decisions on professional expertise, the risk will remain that instead of extinguishing the fire of inflation, they may inadvertently fan its flames.

Figure 2. Structure of sources of inflation

Figure 3. Comparison of Inflation between Mongolia and Other Countries (%)