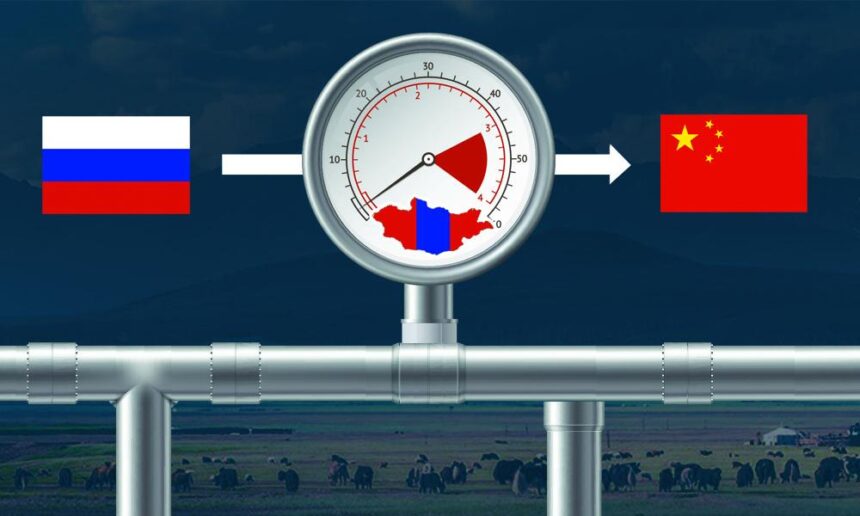

From 3rd to 6th December the Prime Minister of Mongolia U. Khurelsukh officially visited the Russian Federation. During this period a number of meetings were arranged and several documents on gas pipeline were signed. In Moscow, the Deputy Prime Minister O. Enkhtuvshin and CEO of Russian Gazprom A.B. Miller signed a memorandum on this case. At the same day a natural gas pipeline “Power of Siberia – 1” was officially opened.

Although for the last 20 years Mongolia has been expressing the desire to provide a gas pipeline between Russia and China, there was no positive response until recently. What influenced the decision of the two neighboring states? It is the geopolitical wind that made them choose to head in a more unlikely direction.

Russia’s other way

Being the world’s largest gas exporting country, today, Russia has 20% of the world’s gas reserves and 17.3% of manufacturing. Russia provides one fifth of the natural gas that supplies Europe. Sixty-three percent of Russia’s export revenue and half of its federal revenue come from oil and gas.

However, in 2014 this huge export market was under threat when the conflict of the Crimean Peninsula led western countries under the leadership of US to put in place sanctions. Despite of supplying 142 billion cubic meters’ gas through the 1240 km pipeline in Ukraine annually, its political risks grow. To replace this route, the Nord-Stream-2 pipeline would be opened by mid of next year, providing 55 billion cubic meters per year through the bottom of the Baltic Sea to Germany and other parts of Europe. But this proposal fell under sanctions. President V. Zelensky recently announced that western sanctions will continue until the Ukraine gets its territory back.

The Turkish bay that would provide gas to Eastern Europe to reach Istanbul will be opened in the beginning of the next year. From this 1100 km long bay 31,5 billion cubic meters of gas will be transferred to Bulgaria, Serbia, Hungary, Slovakia and is not only expected to be cheaper than US liquefied gas, but also relatively less vulnerable to Western sanctions.

In 2014 the ‘Power of Siberia – 1’ started stretching the natural gas project to China which is the biggest gas project in Asia market as well. It is a 3000 km-long pipeline that goes to the Chinese border all the way through the Siberian taiga with its moat, mud and permafrost and is connected to a 3500 km long pipeline in Shanghai. From 2025 it will supply 38 billion cubic meters of gas per year for 30 years – that is how the $400 billion contract starts. The Gazprom pipeline was estimated to cost $55 billion, however, considering the ruble’s fall and the fact that bulk of its work and materials were provided by Russia, the real cost is $29 billion, according to the Oxford Research Institute.

To close the Europe market risk Russia has been finding other ways to supply natural gas to Asia. “In order to create competition between Europe and China” …” the Power of Siberia – 2 pipeline will be laid through Mongolia instead of the Altai project implementation” said deputy head of National Energy Security Fund A.Grivich (Ros. Gazetta. 19.12.05).

China’s double strategy

Asia, and especially China, is the most advantageous market for Russia. For the last two years China’s natural gas consumption increased by 33% and accounted for 40% of the world’s consumption in 2024. Therefore, China began to draw closer to Russia and the above-described big contract was created. However, the ‘Power of Siberia – 1’ project in its full force will cover only 20% of China’s liquefied gas annual import.

According to the Japan Times (19.12.05) newspaper, a gas partnership between China and Russia will affect Japan. The relatively low price of Russia’s natural gas will lead to a fall of the world energy market price and to changes in trade routes. While Australia, China’s longtime supplier, will lose its revenues, it will be beneficial for Japan in the long run. This partnership will soon affect the $200 billion turnover. Strategically, this partnership is to decrease the US influence. In addition, due to the trade war, from June 2019 China raised gas tax on US import from 10% to 25%. The intention was to reduce the supply in 2019, which reached 2.5 billion cubic meters of gas last year. Presumably, the decrease of coal usage in India and Southeast Asia countries will increase the demand on natural gas and countries will connect to China’s pipeline. In this case, China will have the opportunity to export Russia’s natural gas.

As the natural gas pipeline extends, the trade of liquefied gas is likely to decline.

Mongolia’s new challenge

Thus, the emerged geopolitical reality has changed the policy of China, which had previously refused to allow gas pipelines to move over another country. Same for Russia: instead of choosing the highland Altai route to Urumqi (where gas reserves are abundant) by higher expenses, flat swamp less Middle Asian territory is preferred. In order to supply the constantly growing city of Beijing, Mongolia could be used for the shortest path.

According to Kommersant (19.12.04), D.Akishin from Russia’s VYGON Consulting company announced that a 1060 km-long pipeline will be stretched along Ulaanbaatar Railway (UBTZ) jointly owned by the two governments. In the next two years, the detailed technical drawings and economic calculations will be completed, and in the next four years the construction will be finished. It is a feasible aim for Gazprom, which previously constructed a 100.000 km-long line. Meanwhile, Russia and China will agree on the price, Mongolia will charge transmission payment in dollars and gas.Plus, the Irkutsk region will be provided with gas along the way to Mongolia.

To understand how the transmission of 38 billion cubic meter of gas per year will impact the Mongolian economy, I refer to my article called “The economics of natural gas favor Mongolia” which was written last year. The transmission of gas through Mongolia is a technical issue now. All decisions were made, and the pipeline project is beneficial for all sides. Hopefully, this major project will not fail under the Mongolian’s corrupt politician’s competition as it is happening with the 5th power plant which has been in discussion for 20 years, and while the footings were installed 10 times, the project has not come to light.

2019.12.11

Trans. by Riya.T and Sungerel.U