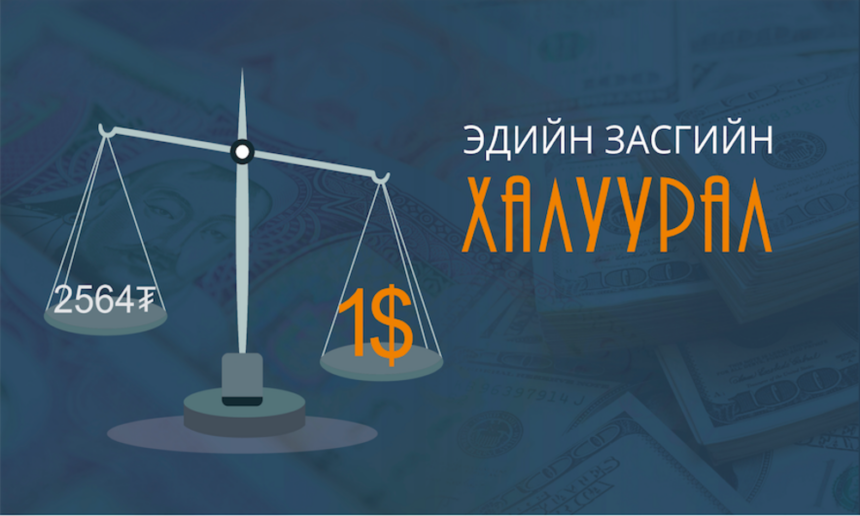

In past few days, the Mongolian tugrik (MNT) has depreciated against the US Dollar (USD) by 3.4 percent. MNT has continuously depreciated for some time, with 1 USD being 2500 MNT in January 2017, 2000 MNT in May 2016 and 1000 MNT in January 1999. In the last two years, there has only been a slight fluctuation. If we assume that 2500 MNT is considered as normal, and normal body temperature is 36C, then the Mongolian economy has a slight fever.

A fever can be treated with pills temporarily. This would mean that the Bank of Mongolia would reduce its reserves and support MNT as usual. However, the BoM sells the dollar and has not stopped the depreciation of MNT, which is a major threat to many people, especially those who borrowed in dollars.

The fever may be temporarily cured with pills, but it is not possible to treat the sickness completely without finding the underlying reasons. Even if the BoM sold all its reserves, but MNT is still weakening and the USD strengthens, the economy will continue to depress if we do not find out the real cause of the economic fever.

The external causes of the fever

The US Federal Reserve has slightly raised its interest rate to 2.5 percent. In addition, the US dollar has strengthened globally as US companies have withdrawn their capital back to the US due to the Trump Administration’s trade policies. For instance, the Turkish lira and Argentine peso have slumped.

Our northern neighbor, sanctioned by the West, has recently increased gasoline and fuel export prices to maintain the strength of the ruble. As regards our other neighbor, the Chinese Yuan weakened by 8 percent last year, but it has not increased taxes on coal, copper and gold, although quotas have been set. However, the external causes of depreciation of the MNT are significantly less important than its internal causes.

The internal cause of the fever

Mongolia’s external debt is too big relative to its economy. This has negatively affected the MNT rate as debt and interest on the debt are paid in foreign currency. The total amount of external debt of Mongolia is now 27.7 billion USD, in other words 2.5 times larger than its economy. Out of this, 8 billion USD in Government debt interest was reduced and is to be paid in loans under the IMF program.

Even though the internal debt of the Government is decreasing, BoM’s bonds have increased. As of September 10, 2018, the monthly central bank bonds amounted to 4.2 trillion MNT, an increase of 8 times compared to 2 years ago.

While the Government debt and the Central bank debt are growing fat, the state budget has been approved as a deficit; i.e. the state spends more than its earnings. Despite increasing state revenues by rising taxes, the private sector, which creates the largest number of jobs has been shrinking, and the unemployed are leaving the country. Also, the government cannot fully disclose or report on returns from projects implemented by foreign bonds, which indicates that these projects have not been able to repay the loans from from the government’s loan portfolio. The government has spent inefficiently on many projects, which have not been implemented, yet no one is liable. That also causes MNT depreciation.

Mongolia pays hundreds of millions dollars in penalties imposed by international arbitration courts due to corrupt or misleading government decisions and state-owned companies’ actions.

Our economy has always been dependent on commodity prices and so far, we have not found a way to diversify the economy away from mining. Besides cashmere products, a small portion of meat and meat products are currently exported, but they are sold for domestic market prices, meaning that this business is not profitable over the long term.

Monetary and Fiscal Policy

The BoM is obliged to maintain the stability of the national currency and lower the inflation rate. Currently, the inflation rate is 6.2, and therefore the 10 percent interest policy rate can be reduced and the money supply can be enhanced. However, our main exports such as coal, copper and gold tend to be at lower than international prices, so a reduction in the policy rate is not demanded.

Banks are borrowing cheaper loans in dollars and lending in dollars domestically. The volume of loans grew by 30 percent from the beginning of this year and 40 percent of all loans are in dollars. It impacts on the currency rate when borrowers obtain loans in dollars because of the lower interest rate (roughly 10 percent), whereas they earn revenue in MNT. The Bank of Mongolia encourages commercial banks to lend in MNT to share exchange rate risk, and the amount of risk fund for non-performing loans increased from 120 to 150 percent.

The Asian Development Bank (ADB) last week increased Mongolian economic growth outlook from 3.8 percent to 6.4 percent for 2018. Despite the economic recovery, non-performing loan repayments require attention. From the beginning of the year, a 40 percent rise in imports has meant an increased need for dollar, sending the MNT exchange rate soaring.

At the same time, under the current economic circumstances and public governance situation, BoM’s intervention in reducing the currency reserves is virtually impossible, while on the other hand, it will not be able to support a half-year of imports.

Mongolia may not be able to repay its foreign and domestic debt, like Zimbabwe and Venezuela, unless it fights against corruption, introduces more accountability into state procurement, reduces the budget deficit, stops borrowing and makes a report on every single dollar that is borrowed from abroad to increase its efficiency.

The Government shouldn’t count its chickens before they are hatched.

2018.10.03

Trans. by B.Urtnasan