President Kh. Battulga is back from his trip to Vladivostok, where he attended the Eastern Economic Forum and had engagements with leaders from our neighboring countries. An agreement was made to upgrade power plants 3 and 4, as well as the Ulaanbaatar railway, with a soft loan of 100 billion rubles from Russia. In addition, the Russian president supported putting natural gas pipelines through Mongolia while the Chinese president promised to look into it from an economic perspective.

Natural gas is a strategically important source of fuel for the fast growing China. If the pipeline goes through Mongolia, we will be able to generate revenue from having natural gas transported on our territory. A part of this income can come in the form of natural gas that will help eradicate air pollution in Ulaanbaatar, and the rest could be in cash, which will help our economy. Therefore, the importance of this topic is quite high.

Building pipelines to transport or import oil and gas is not only a technically challenging piece of work but also a complex issue dependent on many factors such as geopolitics and energy economics. Russia has spent nearly ten years negotiating with China to build natural gas pipelines that go around Mongolia and connect with China. In 2014, they signed an agreement in Shanghai. While the supply of gas was supposed to start in 2018, the date has been postponed to the end of 2019.

Soaring demand from Chinese market

In 2017, China used 238 billion cubic meters of natural gas, which puts them only behind the United States and Russia. Sixty per cent of their total consumption came from domestic sources, 19 per cent from pipelines from neighboring countries (Turkmenistan, Myanmar), and 21 per cent in the form of liquefied natural gas (LNG) from exporters far away, which included Australia (50 per cent of LNG) and Qatar (20 per cent). China has become the global leader in imports of LNG.

Natural gas accounted for 7 per cent of China’s total use of electric power, and the figure is expected to grow to 10 per cent in 2020. The U.S. Energy Information Administration reported that as a result of the war China waged against air pollution, their demand for this ‘blue fuel’ has grown every year and will reach 360 billion cubic meters in 2020. China is turning its big cities over to the use of natural gas and converting the engines of all buses and trucks to LNG engines. Therefore, China is aiming to have reserves that can last at least ten days.

The Chinese demand for electric power, especially energy from blue fuels, is growing continuously. According to the U.S. Department of Energy, China’s domestic production of natural gas will increase by threefold by 2040, but they will still need to meet two-thirds of their total demand from natural gas and LNG imports.

Given that China will continue increasing its natural gas imports, tariff wars still lurk around the LNG they import from the United States.

Russia’s natural gas exports

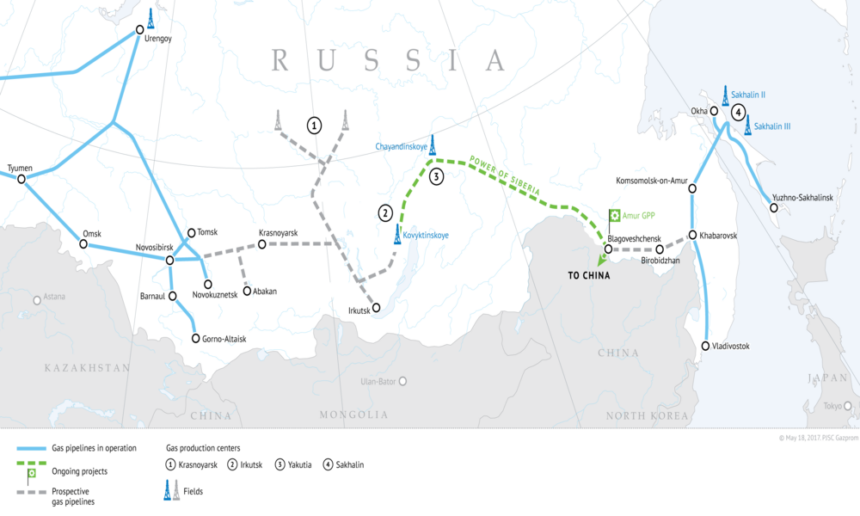

As of 2016, Russia held the biggest reserve of proven natural gas resources (47 trillion cubic meters) in the world. It is considered to have 25 per cent of the world’s total natural gas reserves. Seventy per cent of Russia’s reserves lie in three big gas fields in the western Siberia: Urengoy, Yamburg, and Medvezhye. The rest are located in the eastern Siberia and on Sakhalin.

Gazprom started a huge project named the Power of Siberia to build a 2,200-kilometer-long pipeline from the Chayanda oil field, which is located to the northeast of Baikal Lake, to the city of Blagoveshchensk, and then to connect with the Kovykta gas field to the north of Irkutsk with a 800-kilometer-long pipeline. Vitaly Markelov, Deputy Chairman of the Gazprom Management Committee, has recently announced that the first part of the project will be completed next year. As of today, 40 kilometers of pipelines are yet to be built.

The 2014 Shanghai agreement essentially said that Russia would invest 55 billion USD in building this pipeline, which will carry natural gas to China for 30 years, with a total estimate of sales worth 400 billion USD. It took a very long time for them to agree on the price, which is set to be cheaper than the gas sold to Europe (less than 350 USD per thousand cubic meters) on a take-or-pay arrangement. Therefore, this pipeline, which has a diameter of 1.4 meters, will transport 38 billion cubic meters of natural gas per annum.

Mongolia’s corridor

If we assume that the agreement between the presidents is realized, a project will be implemented to build a pipeline of more than 2,000 kilometers from the Kovytka gas field, which is East Siberia’s biggest gas field with a proven reserve of 2.5 trillion cubic meters, through Ulaanbaatar to the Chinese border. We can then develop a rough estimation of its impact on Mongolia’s economy.

If we based the estimation on the numbers from the Power of Siberia project published by Gazprom in 2015, it will require an investment of 246 billion rubles to build a 1,000-kilometer-long, 1.4-meters-diameter pipeline along with nearly ten compressor stations on Mongolia’s territory.

If we assume the transport capacity stands at 30 billion cubic meters and use numbers from some contracts (1.09 USD for transporting one thousand cubic meters over a 100-kilometer distance), Mongolia can receive 300 million USD every year. The exact number will clearly be different, given that the contract will be established with assistance from international experts on distance and weight of natural gas to be transported.

Building a gas or oil pipeline through Mongolia’s corridor would be a relatively economic option to connect Siberia to Beijing and other large cities in China. It will also be the shortest route – even closer than through central Asia or Manchuria.

Clearly, the economics of the project heavily depend on the international markets for oil and natural gas. For example, the Russian ruble is currently dramatically weakened, putting heavy pressure on Russia’s economy. Since the annexation of Crimea, the sanctions on Russia by the western world have been getting stronger. It is also projected that China will see the most impact from a trade war between them and the United States.

However, regardless of international circumstances, Chinese energy demand, especially for natural gas, cannot be slowed down. It is on an upward trajectory, therefore building a pipeline in Mongolia would benefit all three countries. Also, building the pipeline around Mongolia would require overcoming mountain ranges and will be twice as long and as expensive as building it through Mongolia’s territory.

Therefore, the economics of natural gas pipeline favor Mongolia. The only concern is that, because our public governance is corrupt and non-transparent, the pipeline project could even worsen the resource curse.

2018.09.19

Trans. by B.Amar