Many governments impose excise taxes on producers and suppliers in order to restrict people’s consumption of specific goods such as alcohol, tobacco, cars, diesel fuel, and gambling. Not everyone knows about this tax because it is not drawn directly from the consumer, but through the vendors. This excise tax is a very special type of tax, given it is one of the biggest revenue sources for the public budget and can virtually be spent on anything.

Mongolia has a set of laws regulating how the excise tax is collected and then paid to the public budget. However, there are no laws on where the tax revenue should go and how it should be spent.

For example, our government has turned the excise tax on petrol and diesel fuel into a tool to restrict prices. The purpose of this specific tax is supposed to be reducing air pollution, mitigating adverse health impacts, improving traffic efficiency or increasing productivity. It is not meant to be something the government uses to control prices.

Similarly, there is little awareness on where the revenue from excise taxes on alcohol and tobacco goes, what it is used for, and how it can help protect public health.

Taxes on duty-free goods

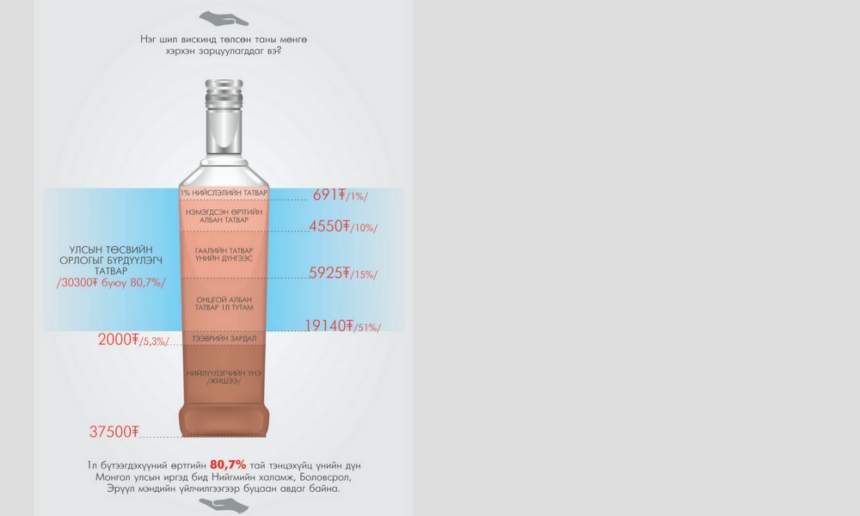

Whisky is an example of goods brought from abroad as a gift. This is largely because whisky can be bought at a duty-free shop for a price 2-3 times less than what you find in stores. Let’s have a look at the cost breakdown of a 1L bottle of whisky. We can put 15 USD (36,750 MNT) as benchmark for the cost of this bottle of whisky when it arrives at our border. When you add transportation (cost estimated at 2,000 MNT) and customs special tax at 15-40 per cent (not 5 per cent as other goods), its cost reaches 44,560 MNT. When you further take into account the excise tax per unit (19,400 MNT), VAT tax at 10 per cent, and the 1-per-cent tax imposed in Ulaanbaatar, the total cost would come to 70,000 MNT.

At a duty-free shop, the base cost of this bottle of whisky is 38,750 MNT – almost twice as cheap as the previous sum. This is a highly profitable business for those who trade illegally. It can be seen from the experiences of many countries that higher taxes make illegal trading turnover grow, which in turn increases the crime rate. As there is more illegal supply, customers, including bars, restaurants, stores, and individuals tend to have a stronger interest to buy from unofficial sources rather than going through the official channels.

Law-abiding businesses increasingly run deficits and find less profits when they operate in countries like ours, who are not doing well enough to ensure that laws are followed. At the same time, black markets grow, and the public budget sees less revenue flowing in from excise taxes. It also contributes to poorer quality goods, which can negatively affect people’s health. In other words, when law-abiding businesses, customers, and the government face negative consequences, illegal traders and their corrupt network grow prosperous, taking advantage of taxes on duty-free goods.

Today there is an increasing amount of small-time trade of alcohol and tobacco sold and bought by individuals in European countries. This shows that illegal trade grows when excise taxes are too high. In Mongolia, we are now seeing advertisements on social media and even at entries to apartment blocks that people are selling goods they bought from duty-free shops at a cheaper price.

Excise tax on alcohol and tobacco, and domestic production

The annual increases on excise taxes are not only reducing the amount of imported goods and their tax revenue, but also increasing domestic production of alcoholic beverages.

A 2014 report from the World Health Organization ranked Mongolia 83rd out of 191 countries in terms of alcohol consumption per person over 15 years old. This report converts alcoholic beverages into pure alcohol and suggests that the average consumption of a Mongolian is 6.8 liters per annum, emphasizing that 70 per cent of total consumption was traditional and regular vodka.

Mongolia currently has 48 entities that produce vodka and alcoholic beverages. In the last two years, Mongolia’s production and export of beer increased by 8 and 100 per cent respectively, while import and consumption decreased by 60 and 4 per cent. Our wine production increased by 28 per cent, while its import and consumption also saw an increase of 30 and 33 per cent respectively. If you look at vodka, its production, import, and consumption grew by 3, 36, and 4 per cent respectively, but exports reduced by half. The revenue from excise taxes on alcoholic beverages reached 180 billion MNT in 2017, which means a 5 per cent increase from the previous year constituting 3 per cent of total revenue. In short, Mongolians are consuming more vodka as consumption of beer decreases, and the use of wine saw a drastic increase compared to vodka (8 times as much).

Mongolia has been increasingly seeing more alcoholism, crimes, accidents, and adverse health impacts. This shows that there is demand for public awareness work on responsible use, and related measures to be taken with a scientific approach.

In order to stop illegal trading and reduce consumption of alcohol, we should embed a culture of responsible use, raise awareness amongst teenagers, and provide better information including details on specific products and their production process, to the public.

As mentioned above, Mongolia does not have any specific law that regulates the spending of revenue from excise taxes. However, the law against alcoholism states in Clause 9.1 “The state administration center, local government, press, and education and cultural institutions have the duty to raise awareness of alcoholism and its negative consequences.”

The least we can do is to develop regulations so that these organizations receive some funding from the excise tax revenue to fulfill their campaigning duties and to ensure that they are reporting back to the public.

2018.02.28

Trans. by B.Amar